In this comprehensive guide, we’ll explore how to assess the ROI of BI consulting and data integration services, outline the key metrics, share real-world examples, and explain why a strong ROI is more than just a financial figure.

1. Understanding ROI in the BI Context

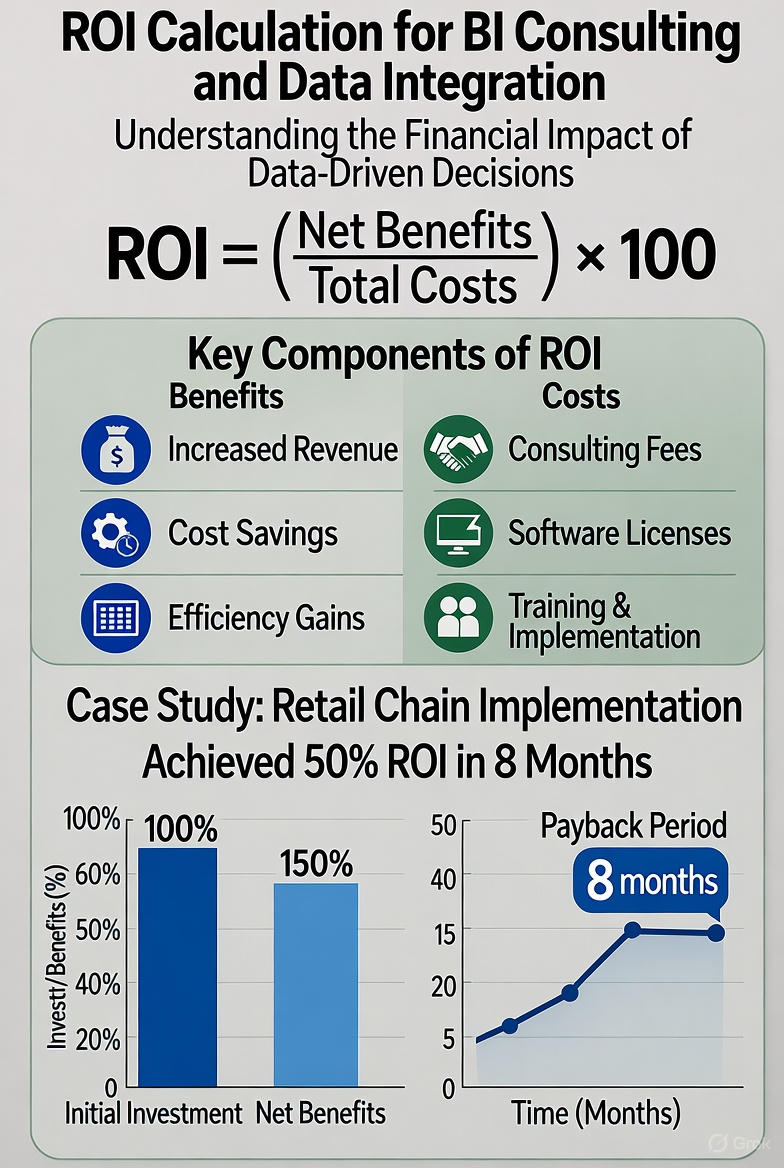

ROI, in its simplest form, is:

However, in BI projects, “Net Benefits” include more than direct revenue as it also accounts for:

Time savings from automation

Operational efficiency from better workflows

Decision quality improvements through accurate insights

Risk mitigation due to enhanced governance and compliance

For example, integrating your ERP, CRM, and POS systems into Power BI can cut weekly reporting time from 15 hours to 3 hours—a cost saving that directly impacts profitability.

2. Costs to Consider in ROI Calculations

Before estimating returns, you must establish a realistic cost baseline. These typically include:

BI Consulting Fees

Strategy workshops

Requirements gathering

Solution architecture

Custom dashboard development

Data Integration Costs

Data pipeline design

ETL (Extract, Transform, Load) process implementation

Data quality improvement

Technology and Licensing Costs

BI platform licenses (e.g., Power BI Pro or Premium)

Cloud storage and compute costs

APIs and connectors

Training and Change Management

Upskilling employees on the BI tools

Establishing data literacy programs

Ongoing Maintenance

Performance tuning

Adding new data sources

Support contracts

Tip: Avoid underestimating ongoing costs—they can be 15–20% of your initial investment per year.

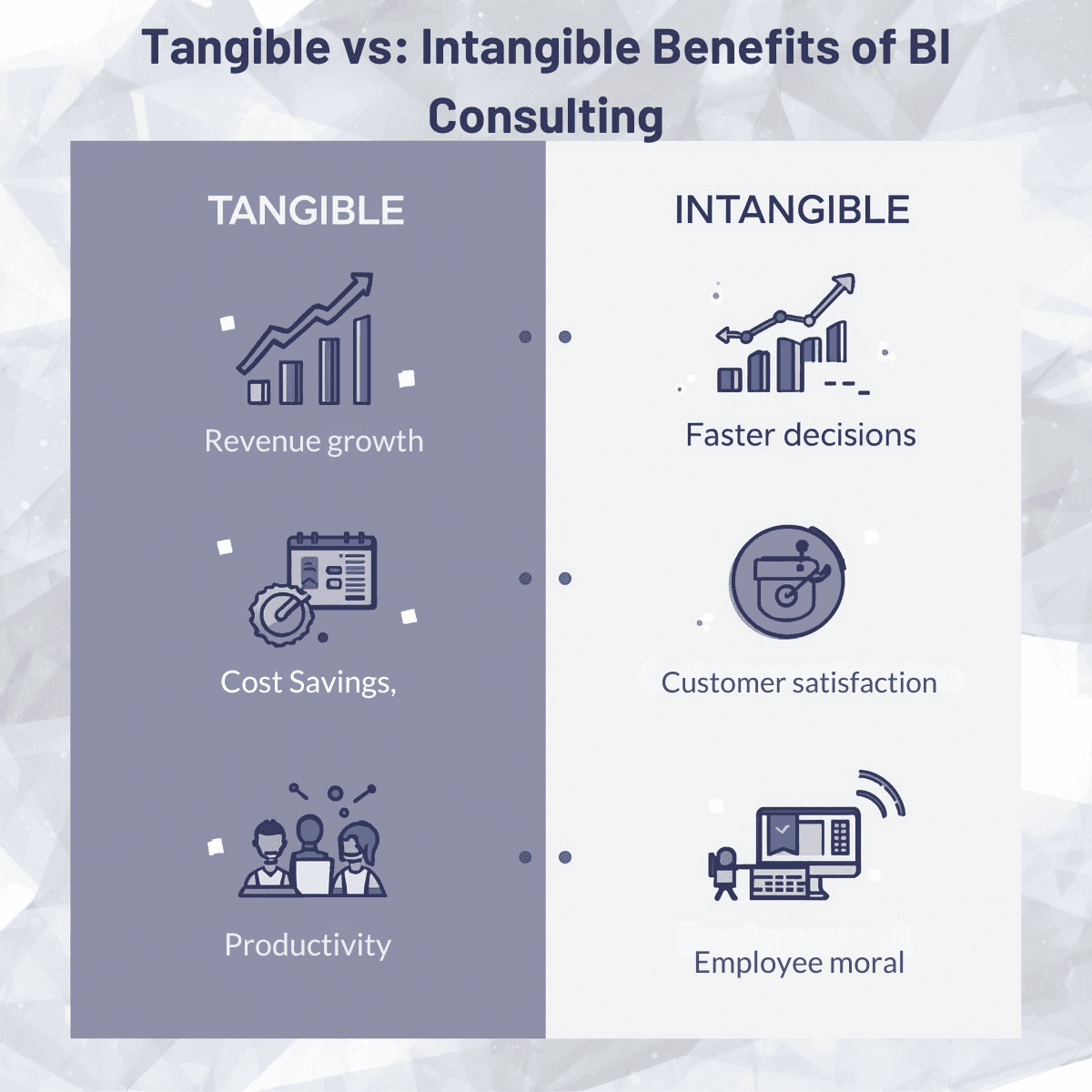

3. Tangible Benefits of BI Consulting & Data Integration

These are benefits that can be measured directly in monetary terms.

a) Increased Revenue Opportunities

BI insights can reveal cross-sell and upsell opportunities within CRM data.

Retailers often find optimal pricing points through analytics, directly boosting sales.

b) Operational Cost Savings

Automation of routine reporting tasks can reduce manpower requirements.

Better inventory forecasting can reduce carrying costs.

c) Improved Productivity

Decision-makers access unified dashboards instead of toggling between multiple systems.

Faster access to insights reduces lag between problem identification and solution implementation.

4. Intangible (But Crucial) Benefits

While harder to quantify, these benefits can dramatically affect business performance:

Faster decision-making

Enhanced customer satisfaction (via personalized experiences)

Better compliance and audit readiness

Higher employee satisfaction through reduced data frustration

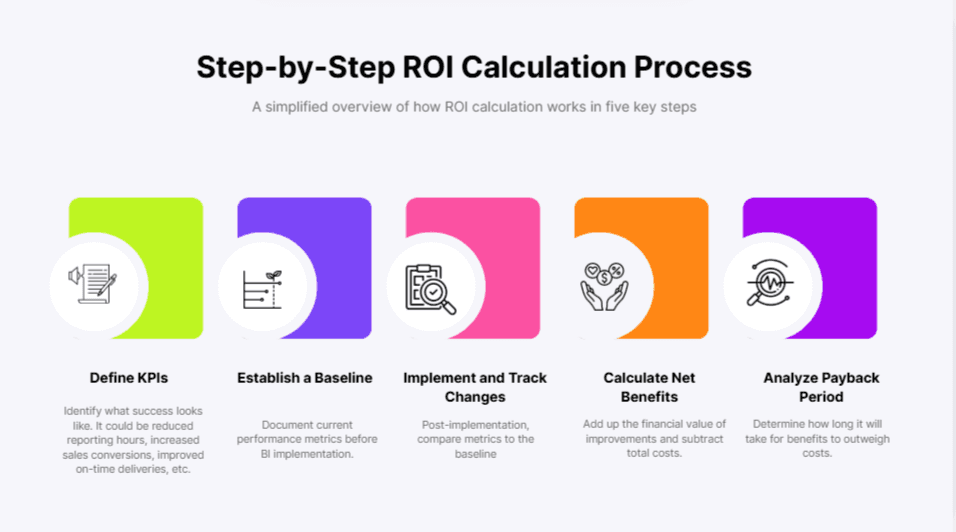

5. Step-by-Step ROI Calculation Process

Step 1: Define KPIs

Identify what success looks like—could be reduced reporting hours, increased sales conversions, improved on-time deliveries, etc.

Step 2: Establish a Baseline

Document current performance metrics before BI implementation.

Step 3: Implement and Track Changes

Post-implementation, compare metrics to the baseline. For example:

Reporting time reduced from 15 hours to 3 hours/week = 12 hours saved × hourly wage × weeks/year.

Step 4: Calculate Net Benefits

Add up the financial value of improvements and subtract total costs.

Step 5: Analyze Payback Period

Determine how long it will take for benefits to outweigh costs.

6. A Retail Case Study

A mid-sized retail chain integrated its POS, ERP, and CRM systems using BI consulting services.

Costs:

BI consulting & integration: $120,000

Power BI Premium licenses: $40,000/year

Training: $10,000

Tangible benefits within 12 months:

Reduced stock-outs by 25%, increasing sales by $150,000

Reduced overstock by 15%, saving $80,000 in inventory costs

Cut reporting time by 70%, saving $25,000 in staff hours

ROI Calculation:

7. Common Pitfalls in ROI Calculation

Ignoring data quality issues: Poor data can undermine BI outcomes.

Overlooking change management: Without user adoption, benefits vanish.

Focusing only on financial ROI: Strategic advantages are equally important.

8. Making ROI a Continuous Metric

The ROI of BI is not a one-time figure—it should be revisited quarterly. Continuous improvement in data integration, analytics models, and user adoption can compound returns over time.

For businesses exploring how to ensure sustained ROI, reading our guide o

an help embed BI success into your organizational DNA.

Key Takeaway

Measuring the ROI of BI consulting and data integration services requires a blend of financial analysis and strategic thinking. By tracking both tangible and intangible benefits, aligning them with business goals, and revisiting ROI regularly, organizations can ensure their BI investments pay off—both in dollars and in competitive advantage.